I've always been interested in making films - and honestly, my ultimate job would be a film director. Alas, no, this is not what this post is about.

I am now, officially, the director of Left Logic Ltd. The company formed on the 6th of September 2006.

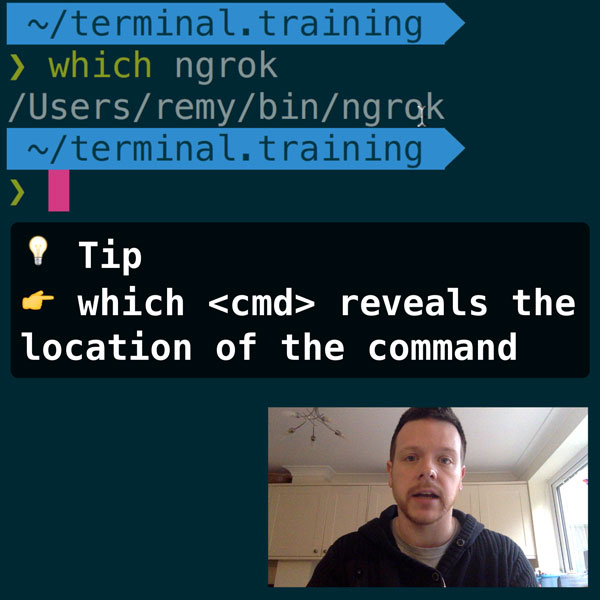

READER DISCOUNTSave $50 on terminal.training

I've published 38 videos for new developers, designers, UX, UI, product owners and anyone who needs to conquer the command line today.

$49 - only from this link

This is an exciting period for me - but equally as frightening. We've (the Wife and I) got our new flat on the horizon, which means, obviously, a mortgage, and if my business does me well, I will finally leave the 'permanent job' nest...well - one day perhaps!

My next steps, aside from finding new clients (on the off chance - visit Left Logic and get in touch!) the next steps are:

- Find myself an accountant

- Open a business bank account (The Abbey are looking pretty attractive with their 'free for life' scheme)

- Register for corporation tax

I'm having a lot of trouble understanding VAT, or certainly what the point is, for businesses.

From what I understand so far is:

- I'm registered for VAT, so I charge you VAT on my services, let's say £1,000 of business.

- I pay the VAT man the VAT I took from you.

- I buy a product worth £1,000 + VAT.

- I claim the VAT from that product from the VAT man.

Doesn't this mean the money is just travelling in circles? One for the accountant me thinks!